Transform Finance with AI Automation

In finance, accuracy and speed are everything. Manual processes create risks, delays, and compliance challenges. AI automation keeps your financial operations sharp, compliant, and efficient.

AI Automation Partner for Finance

We help banks, fintechs, accounting firms, and finance teams automate routine yet critical tasks like reconciliations, compliance checks, financial reporting, and client onboarding. With AI-powered automation, you save time, reduce risks, and improve decision-making.

70%

Reduction in Manual Errors

40%

Faster Report Generation

25%

Lower Operational Costs

2x

Improved Compliance Accuracy

Manual financial operations increase risks, errors, and regulatory exposure.

AI Automation Services for Finance

1

Financial Reconciliations

AI matches transactions across bank statements, ledgers, and payment systems automatically, reducing manual effort.

2

Regulatory Compliance

Automate KYC/AML checks, compliance documentation, and audit trails to stay aligned with regulations.

3

Fraud Detection & Alerts

AI agents monitor transactions in real time, flag anomalies, and send alerts instantly for investigation.

4

Financial Reporting

Generate accurate monthly, quarterly, and annual reports automatically by integrating with ERP and accounting systems.

5

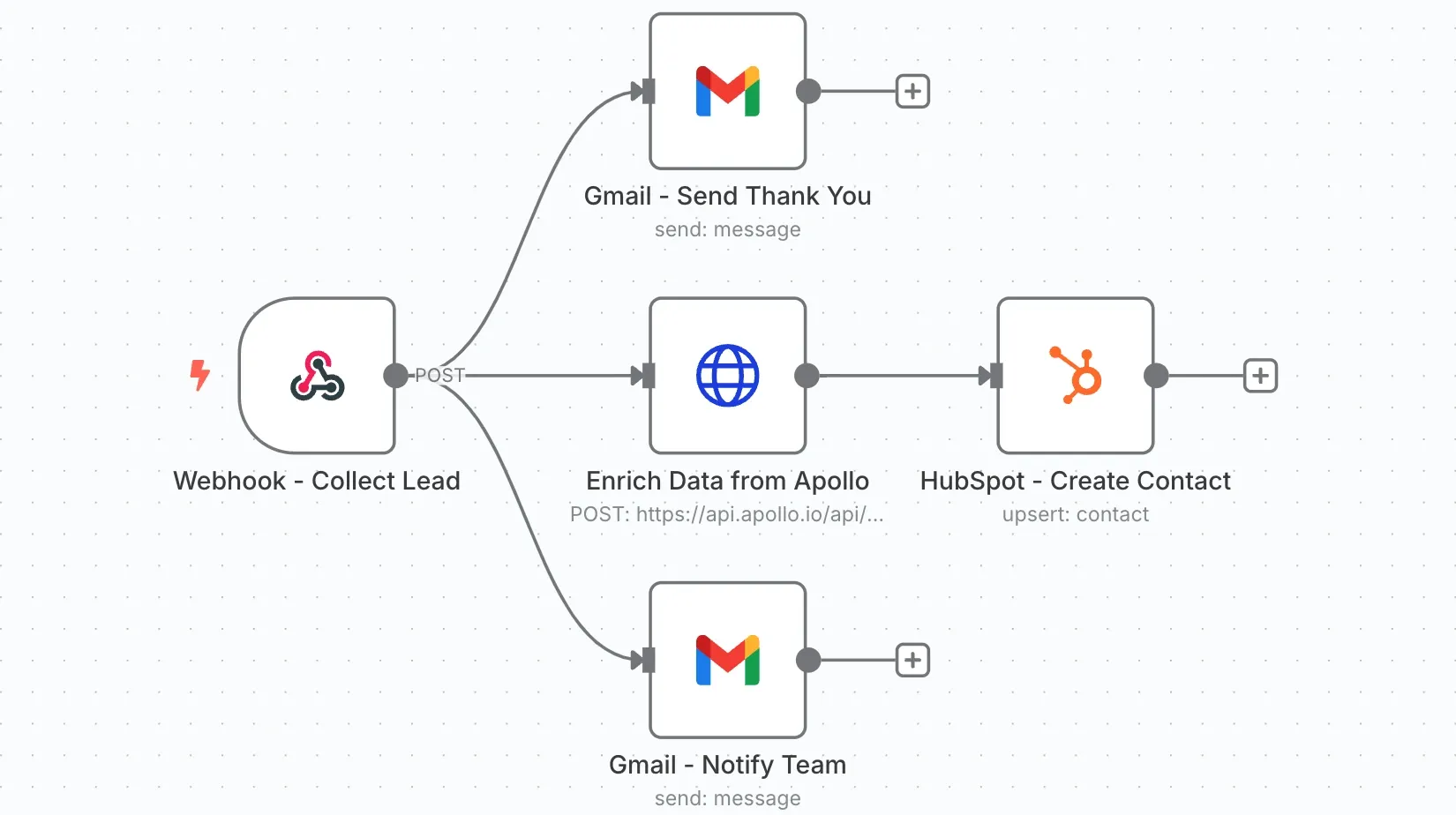

Client Onboarding

Automate client data collection, verification, and onboarding processes for faster account openings.

6

Customer Communication

AI-powered bots answer FAQs, send policy updates, and share account summaries securely with clients.

Benefits of AI Automation for Finance

Fewer Errors

AI automation ensures precision in reconciliations, reporting, and compliance processes.

Time Savings

Automate repetitive financial tasks and free staff for strategic analysis and decision-making.

Enhanced Compliance

AI monitors regulatory requirements continuously and reduces the risk of penalties.

Improved Client Experience

Faster onboarding, instant communication, and accurate statements build stronger trust with clients.

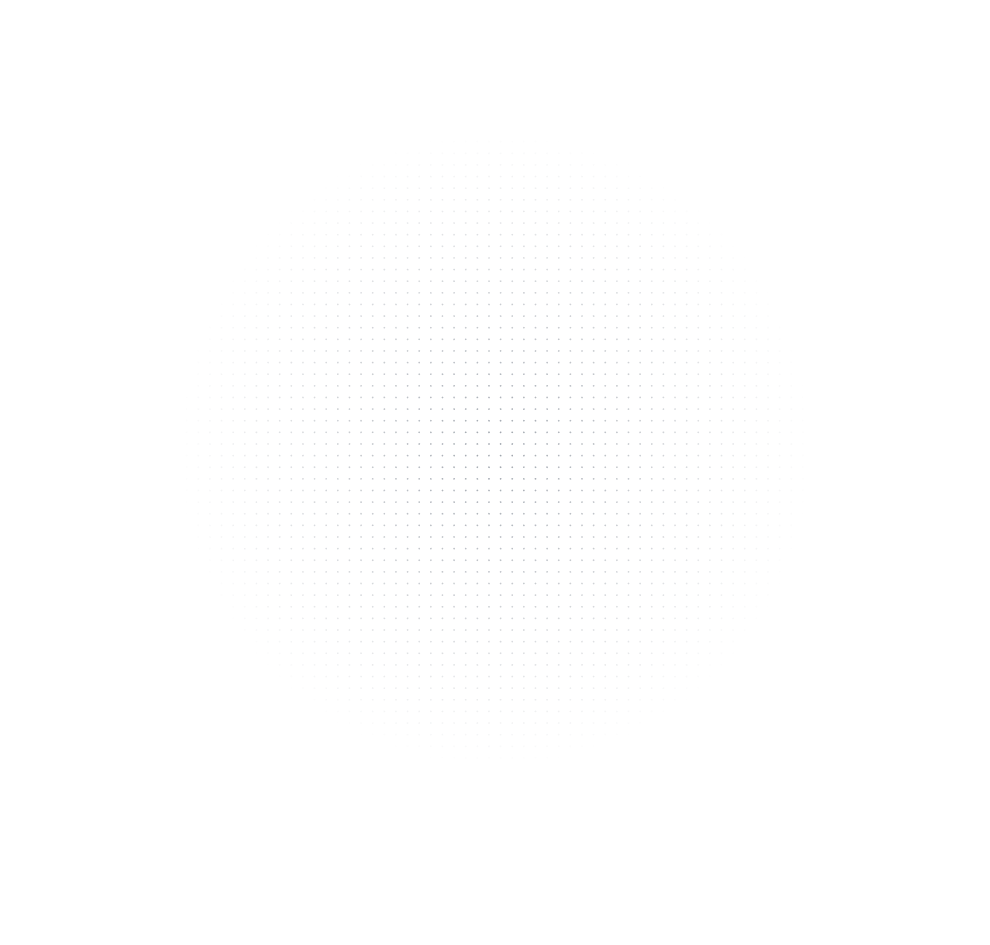

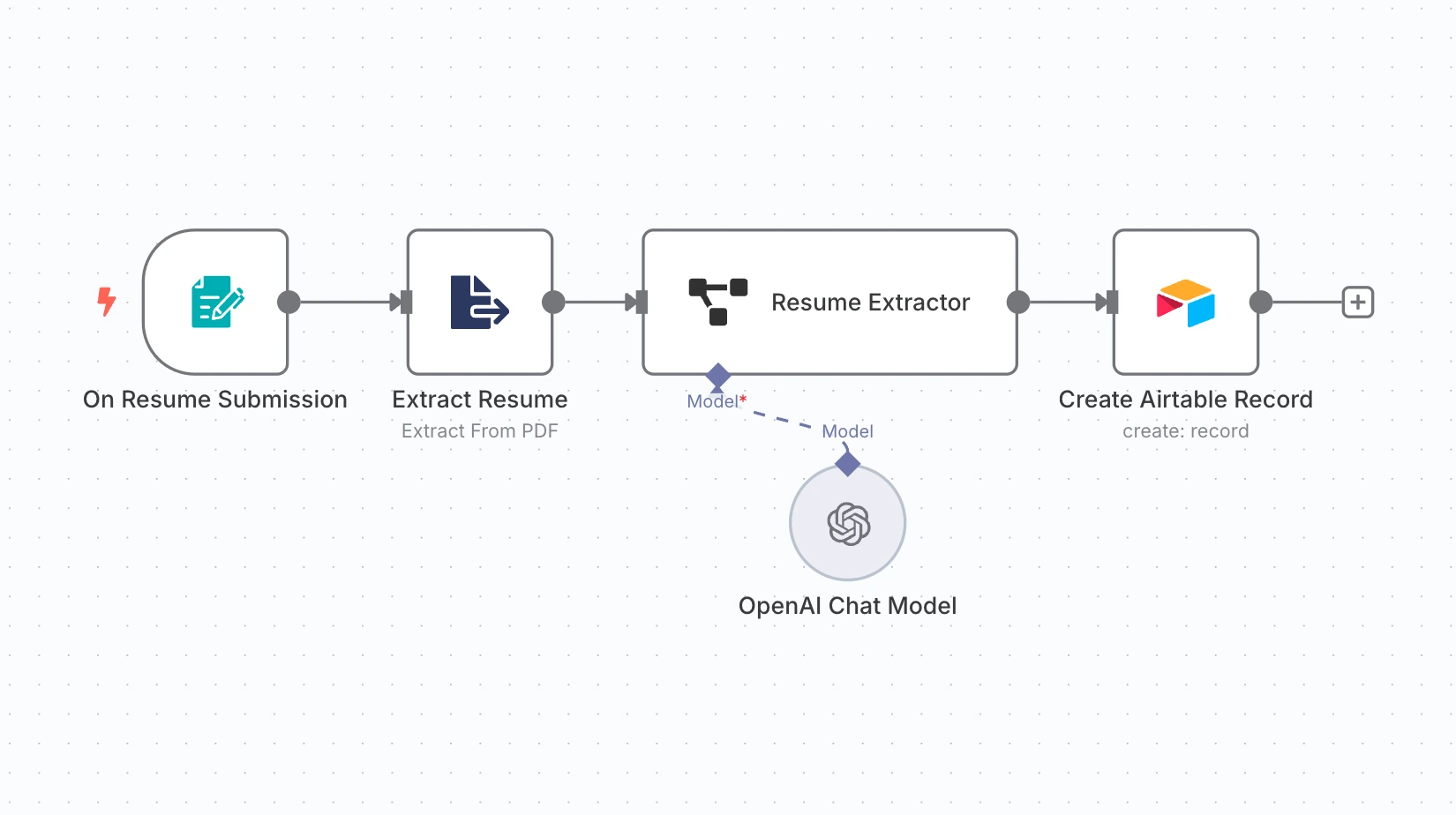

Sample Automation Workflows for Finance

Explore some of our successful AI automation projects that have transformed manufacturing operations.

Finance

Automated Reconciliation Workflow

Finance

Regulatory Compliance Workflow

Finance

Fraud Detection Workflow

Technologies We Use

Zep

Python

Perplexity

Weaviate

Mem0

Tavily

ChromaDB

OpenAI

SerpApi

LangChain

Cohere

PineCone

Why Choose InfyOm for Finance AI Automation?

Finance-Specific Expertise

We understand accounting, banking, and compliance workflows deeply and design automations that fit your needs.

Regulatory Compliance Focus

Our workflows prioritize accuracy and compliance with industry regulations like AML, GDPR, and PCI-DSS.

Secure Integrations

We ensure data privacy and integrate securely with ERPs, accounting platforms, and CRMs.

Proven Efficiency Gains

Our automations save finance teams hundreds of hours annually and reduce operational risks significantly.

Testimonials

We had a great experience with this team, they stayed focused and worked through all of our requests in a timely manor. Looking forward to working with these guys long term.

Jeremy Ferguson

Great skills and quick response and fantastic communication! Highly recommended. Hope to work again in the future.

Peter Kerl

Very good work. Delivered the code with high-quality and within the promised time-frame. I will work with him again.

S Das

Frequently Asked Questions

Is AI automation secure for financial data?

Yes. We follow strict security protocols, including encryption, access controls, and compliance with PCI-DSS and GDPR standards.

Will automation replace finance staff?

No. Automation handles repetitive, error-prone tasks so finance professionals can focus on analysis, strategy, and client relationships.

Can automation detect fraud?

Yes. AI continuously monitors transactions, identifies unusual patterns, and flags suspicious activities for investigation in real time.

How does automation help with compliance?

AI automates KYC, AML, audit trails, and regulatory reporting to ensure consistent compliance with financial regulations.

What financial processes can be automated?

Common processes include reconciliations, reporting, invoice processing, compliance checks, fraud monitoring, and client onboarding.

How quickly can I see ROI from finance automation?

Most organizations see measurable savings in 3–6 months through reduced errors, faster reporting, and lower manual labor costs.

Does automation work with existing ERP and accounting software?

Yes. We integrate with systems like SAP, Oracle, Zoho Books, QuickBooks, Xero, and custom-built financial platforms.

Is AI automation only for large financial institutions?

Not at all. Small and mid-sized firms benefit significantly by cutting overhead costs and improving compliance accuracy.

Can AI generate financial reports automatically?

Yes. AI workflows can prepare accurate monthly, quarterly, and annual financial statements by pulling data from multiple sources.

Do you provide post-deployment support?

Yes. We offer ongoing monitoring, maintenance, and optimization to ensure your finance automation stays efficient and compliant.

Future-Proof Your Finance Operations with AI

Manual processes increase risk and slow growth. Automate your finance workflows and stay compliant, accurate, and efficient.