Revolutionize Insurance with AI Automation

The insurance industry runs on speed, accuracy, and trust. Manual workflows slow claims, frustrate customers, and increase fraud risks. AI automation keeps your business efficient, compliant, and customer-friendly.

AI Automation Partner for Insurance Companies

We help insurers automate claims management, underwriting, customer communication, and fraud detection with AI-powered workflows. By integrating with core systems, CRMs, and compliance tools, we reduce manual errors, improve customer satisfaction, and accelerate service delivery.

50%

Faster Claims Processing

35%

Reduction in Manual Errors

25%

Lower Operational Costs

30%

Increase in Customer Retention

Manual claims and policy processes increase costs, cause delays, and frustrate customers.

AI Automation Services for Insurance

1

Claims Processing

AI extracts data from claim documents, validates information, and automates approvals or escalations.

2

Underwriting Automation

AI reviews applicant data, risk profiles, and third-party data sources to speed up underwriting decisions.

3

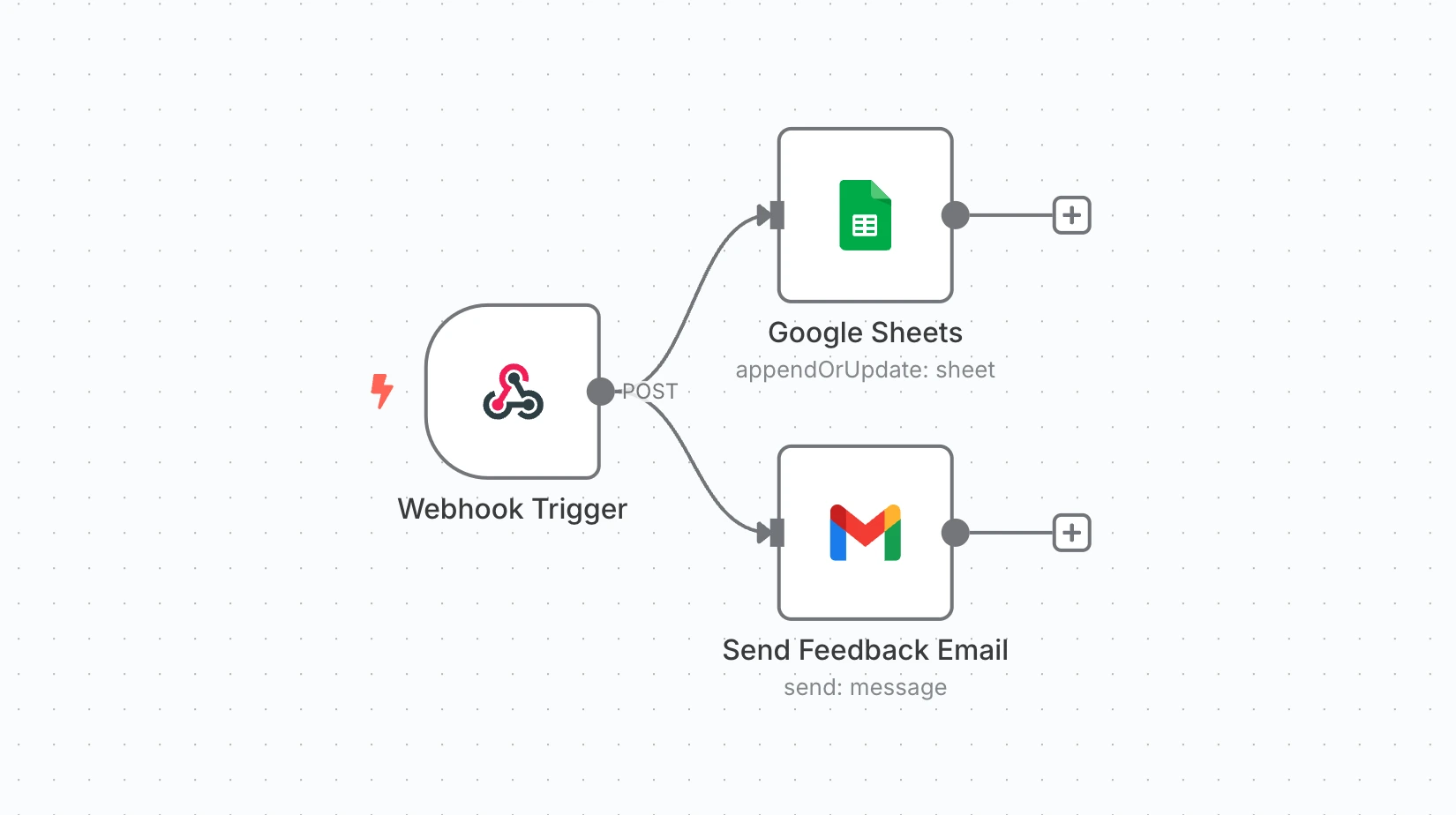

Policy Administration

Automate policy creation, renewals, cancellations, and updates with seamless system integration.

4

Fraud Detection

AI detects anomalies in claims and applications, flagging suspicious cases for investigation.

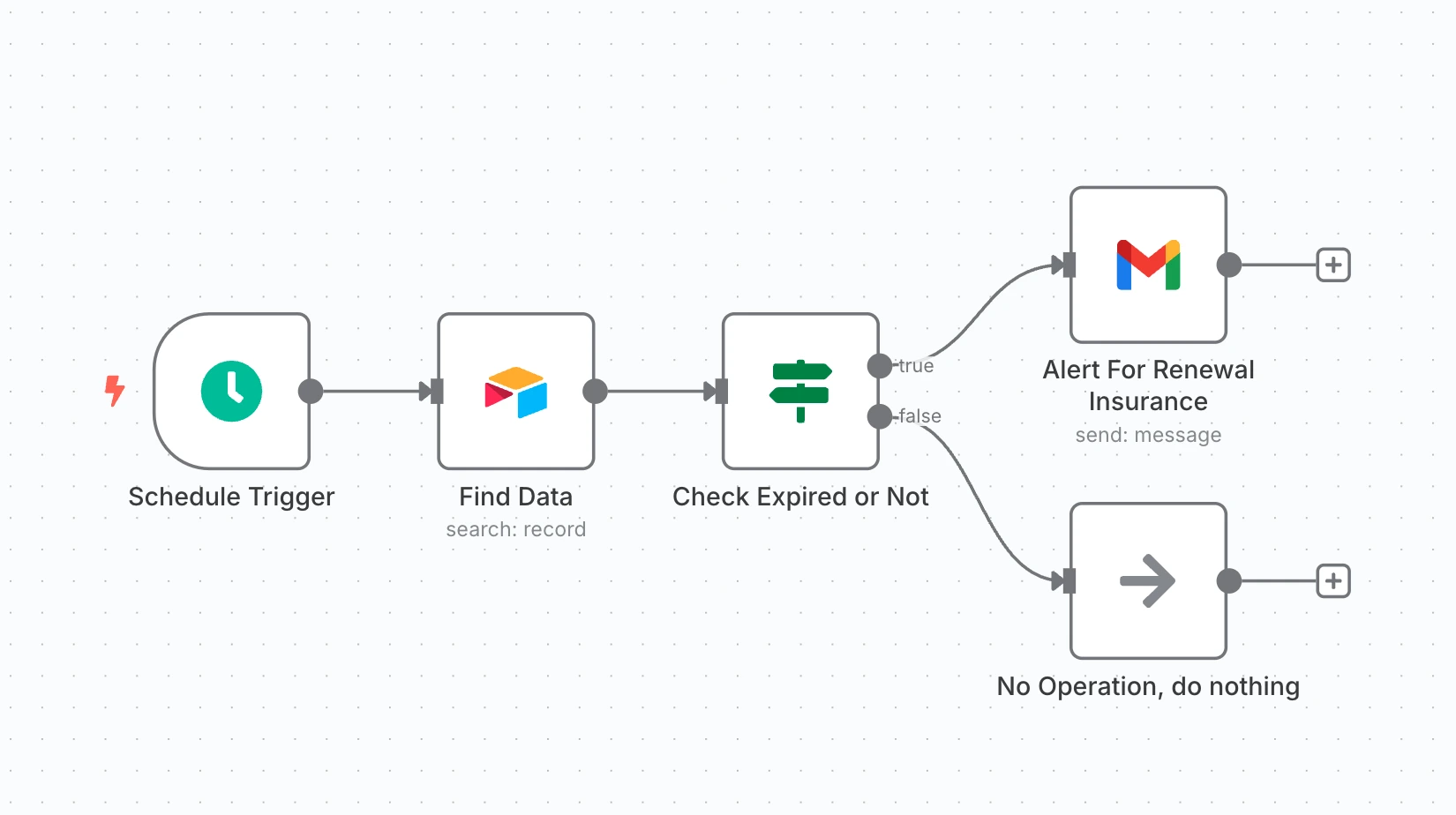

AI-powered chatbots handle FAQs, policy inquiries, premium reminders, and claims status updates 24/7.

6

Regulatory Compliance

Automate compliance checks, reporting, and audit documentation to reduce regulatory risks.

Benefits of AI Automation for Insurance

Faster Claims Settlement

AI reduces claim processing time from weeks to hours, improving customer satisfaction.

Improved Accuracy

Automation eliminates manual data entry errors in claims, policies, and compliance reports.

Fraud Prevention

AI continuously monitors for suspicious patterns, reducing fraudulent payouts.

Cost Savings

Automating underwriting, claims, and customer service lowers operational expenses.

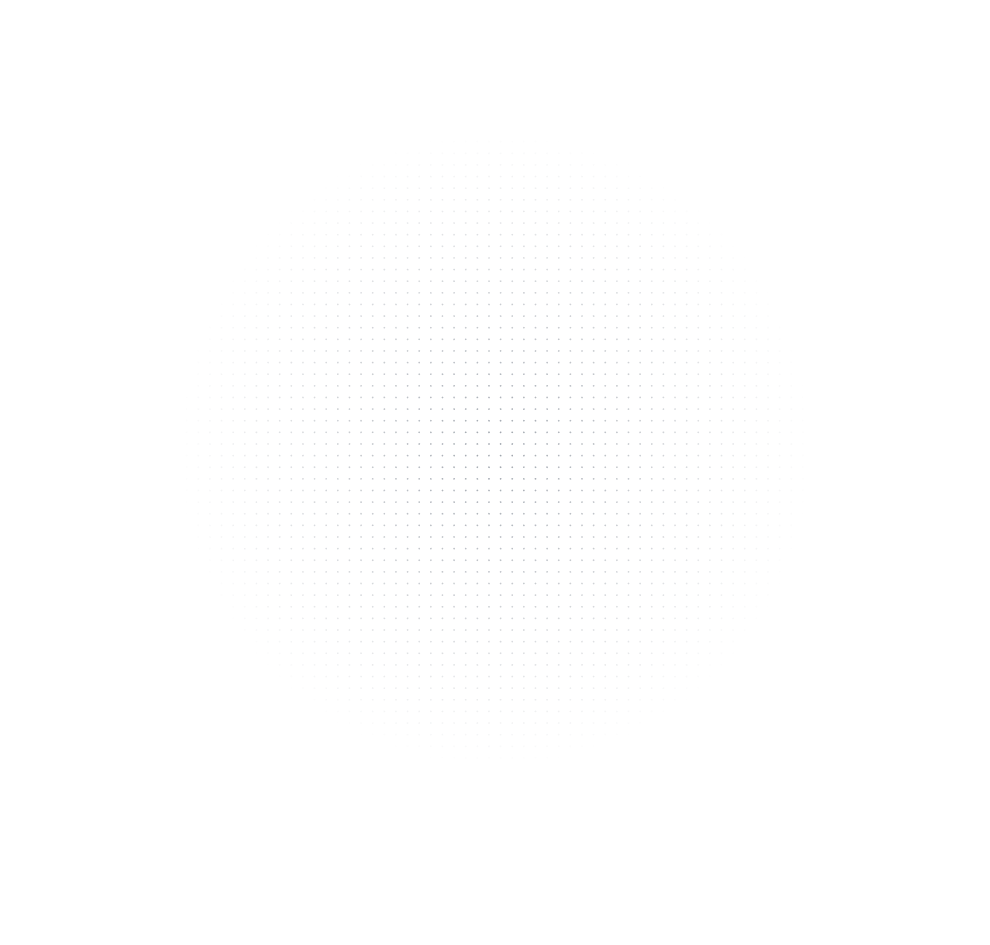

Sample Automation Workflows for Insurance

Explore some of our successful AI automation projects that have transformed manufacturing operations.

Technologies We Use

n8n

PineCone

Airtable

OpenAI

Twilio

ChromaDB

Notion

Slack

Retell AI

SerpApi

Wordpress

Mailchimp

Why Choose InfyOm for Insurance AI Automation?

Insurance Industry Expertise

We understand claims, underwriting, and compliance challenges specific to insurers.

Custom AI Workflows

Our automations are tailored to fit underwriting, claims, fraud detection, and policy management needs.

Secure Integrations

We integrate with core insurance systems, CRMs, and compliance platforms securely and efficiently.

Proven Efficiency Gains

Our clients reduce claim turnaround times, save costs, and deliver better customer experiences.

Testimonials

Working with Mitul and his team is easy and effective. They know what they're doing, very professional and always available. We couldn't hope for more and are very pleased. We will definitely re-hire again.

Patrick Laberge

His an amazing and very professional person. His team is just great. They provide constant update and are willing to go above and beyond. Thanks again! I wish, I meet you before!

Salman Kent

Mitul and his team go above and beyond with the work that they do. It has been a pleasure working on this project with them and we look forward to a long term working relationship.

Muaz Notiar

Frequently Asked Questions

What insurance processes can AI automate?

AI can automate claims processing, underwriting, fraud detection, policy administration, renewals, and customer communication.

How does AI speed up claims processing?

AI extracts claim data, validates it against policies, and approves straightforward claims instantly while routing complex cases to human agents.

Can AI help reduce insurance fraud?

Yes. AI analyzes claim data and applicant behavior to detect anomalies and flag suspicious cases for investigation.

Will automation work with my existing insurance software?

Yes. Our workflows integrate with core insurance platforms, CRMs, ERPs, and compliance systems.

Is AI automation secure for sensitive customer data?

Absolutely. We use encryption, role-based access, and comply with regulations like GDPR, HIPAA, and PCI-DSS.

Can automation improve customer support?

Yes. AI-powered chatbots answer FAQs, send reminders, and update claim statuses 24/7, reducing wait times for customers.

How does AI improve underwriting?

AI analyzes applicant data, credit scores, and third-party sources to accelerate underwriting decisions while maintaining accuracy.

What ROI can insurers expect from automation?

Insurers often see 20–40% cost reductions and improved customer retention within the first year of adopting AI automation.

Is automation suitable for small insurance firms?

Yes. Small and mid-sized insurers gain agility and cost savings, allowing them to compete with larger players.

How long does it take to implement automation in insurance?

Most insurance automation workflows can be deployed within 6–10 weeks depending on system integrations.

Modernize Your Insurance Operations with AI

Don’t let manual processes slow you down. Automate claims, underwriting, and customer service to save time and build trust.